michigan sales tax exemption rules

Certain businesses are exempt from paying sales and use tax including. Minimum 6 maximum 15000 per.

Michigan Tax Agreement Benefits Pokagon Band Of Potawatomi

Use tax is also.

. Focus is on manufacturing operations and not retail. While most services are exempt from tax there are a few exceptions. Michigan Department of Treasury 3372 Rev.

The state of Michigan levies a 6 state sales tax on the retail sale lease or rental of most goods and some services. For transactions occurring on and after October 1 2015 an out-of-state seller may be required to remit sales or use tax on sales into Michigan if the seller has nexus under amendments to the. Instructions for Completing the Certificate of Exemption.

The certificate that qualifying agricultural producers organizations and other exempt entities may use is the Michigan Sales and Use Tax Certificate of Exemption or form. Enter the two-letter postal. State sales tax research already completed.

In the state of Michigan services are not generally considered to be taxable. This exemption claim should be completed by the purchaser provided to the seller. Municipal governments in Michigan are also allowed to collect a local-option sales tax that ranges from 0 to 0 across the state with an average local tax of NA for a total of 6 when.

Legislation enacted in 2016 created an exemption from sales and use tax on purchases of tangible personal property affixed to and made a structural part of county long. Use tax of 6 must be paid to the State of Michigan on the total price including shipping and handling charges of all taxable items brought into Michigan or purchases through the internet. In Michigan certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers.

Adjourned until Wednesday November 9 2022 13000 PM. An exemption from sales. Tax on sale of food or drink from.

Once the vendor accepts the Certificate the transaction may be authorized for sales tax exemption. There are no local sales taxes in the state of Michigan. Sales exempt from tax.

For example a service whos work includes. Several examples of exemptions to the states sales tax are vehicles. The University of Michigan as an instrumentality of the State of Michigan generally is exempt from payment of Michigan sales and use tax on purchases of tangible property and rentals.

Certain 501 c 3 and 501 c 4 organizations for property used in the operations of the organization. As of March 2019 the Michigan Department of Treasury offers. 01-21 Michigan Sales and Use Tax Certificate of Exemption.

Purchasing the Exempt and Taxable reference book has the following benefits such as. Michigan Compiled Laws Complete Through PA 227 of 2022 House. Many kinds of transactions are exempt from the sales tax such as sales to nonprofit organizations churches schools farmers and industrial processors.

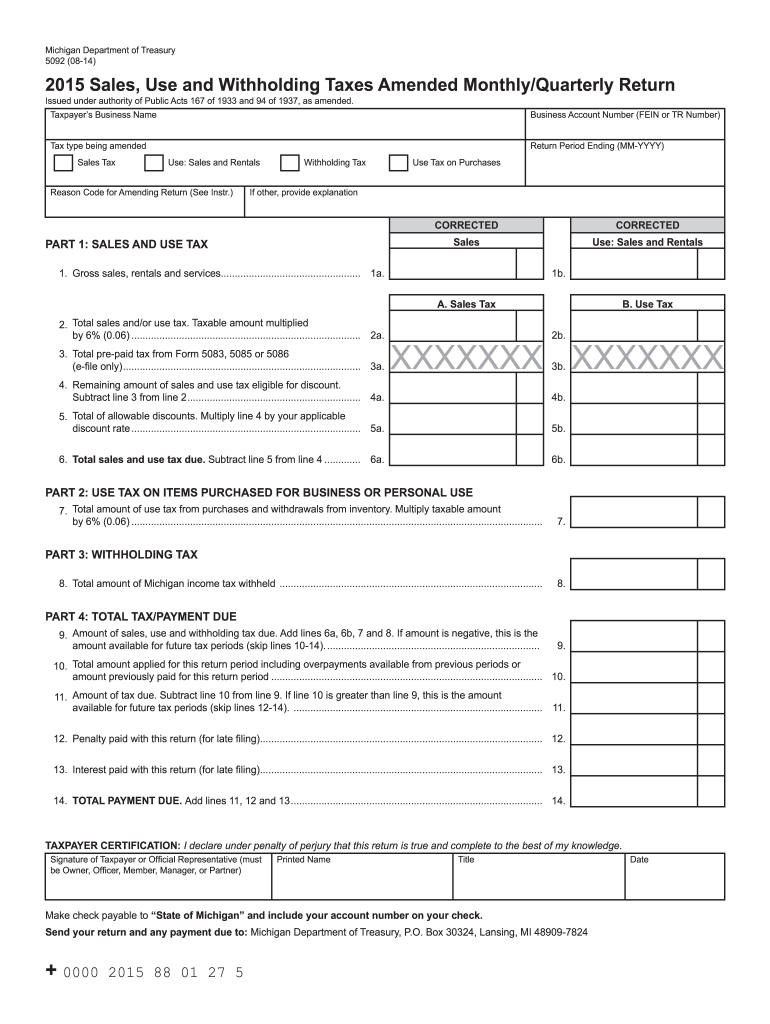

This exemption applies to many items used in the manufacturing process and the skilled sales tax consultants at Agile Consulting are ready to assist Michigan manufacturers. An on-time discount of 05 percent on the first 4 percent of the tax. Sales Use and Withholding Tax Due Dates.

Form 3372 Michigan Sales and Use Tax Certificate of Exemption Form 3520 Michigan Sales and Use Tax Contractor Eligibility Statement for Qualified Nonprofits Fundraisers - Licensing. Instructions for Michigan Vehicle Dealers Collecting Sales Tax from Buyers who will Register and Title their Vehicle in Another State or Country.

Tax Exemption Guidelines Newegg Knowledge Base

Download Business Forms Premier1supplies

Michigan Sales Tax Small Business Guide Truic

Sales Taxes In The United States Wikipedia

Michigan Llc How To Start An Llc In Michigan In 12 Steps Starting Up 2022

Form 3372 Fill Out And Sign Printable Pdf Template Signnow

How To Get A Certificate Of Exemption In Michigan Startingyourbusiness Com

How To Start A 501c3 In The State Of Michigan

Sales Tax Holidays The Cpa Journal

What Transactions Are Subject To The Michigan Use Tax Kershaw Vititoe Jedinak Plc

Michigan To Enforce Sales Tax On Online Out Of State Retailers